In today’s business landscape, having a data strategy is a necessity for sustained long-term growth through informed decision-making. This case study delves into the journey of a SaaS fintech startup that was struggling to meet its annual sales targets due to unsustainable growth fueled by industry hype. Following a systematic approach to business data analysis, the client was able to redesign a more robust strategy for success.

Introduction

In a competitive fintech industry, our client, a SaaS-based fintech startup, set ambitious annual sales targets after experiencing a surge in customer acquisition in the previous year. However, the rapid growth was unsustainable, rooted in industry hype rather than business capabilities. Faced with the challenge of falling short of their sales targets, the founders were in search for a “Marketing Plan.”

Problem Identification

During our initial meeting, it became evident that the client lacked a solid strategy and data-backed decisions. Their approach was primarily based on their initial assumptions and hypotheses, leading to inefficient performance. Recognizing that to start a journey, it’s necessary to know where you are, we proposed a rapid assessment to gather critical metrics that would provide a clear understanding of current business state.

Approach

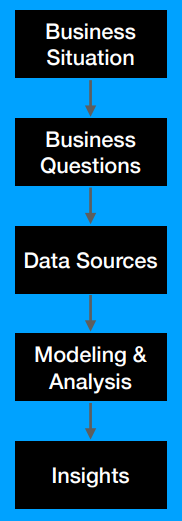

To begin, we helped founders to come at a list of business questions that needed answers. Then each question was mapped to specific analyses and frameworks, which, in turn, required a set of metrics as inputs. This approach allowed us to pinpoint where to focus our data exploration efforts. The client promptly provided access to the required data, enabling us to conduct the necessary analyses.

Key Findings

The rapid assessment phase revealed a pivotal issue: while the startup had gained a relatively big customer base in terms of sign-ups, the conversion funnel for its main revenue driver plan was hugely inefficient. Furthermore, the pricing strategy, originally established on gut feelings, was outdated and couldn’t support different customer segments. These findings provided the client with more reliable reasons to rethink their approach.

Recommendations

Our recommended solutions to achieve business objectives were presented as a set of actions, evaluated based on the risk of implementation and the potential for leveraging revenue growth. In addition, we provided the client with a simple yet essential Business Intelligence (BI) dashboard (The one we created during assessment period for our deep dive) for ongoing metric tracking.

Conclusion

This case study highlights the critical importance of having a data-driven mindset and devising a data strategy from the early days of a startup. By conducting a rapid assessment and delivering actionable insights, we empowered our client to make better decisions and avoid unnecessary costly mistakes.